Investors often seek growth opportunities in diverse sectors, and DPST stock has emerged as a talking point for those exploring leveraged financial instruments. Understanding its role in the broader market requires examining related factors such as risk, economic shifts, and sector performance. By taking a closer look at this security, investors can grasp how it connects with wider market movements, while also comparing it with traditional investments.

Global Market Shifts and Economic Signals

Markets constantly respond to global indicators such as inflation data, employment reports, and central bank decisions. These elements shape how assets move and how investors make decisions. Observing the interplay between economic signals and market sentiment helps create a clearer picture of both opportunities and risks. Short-term fluctuations often lead to misinterpretations, which is why understanding the underlying economic context is essential for better investment strategies.

Understanding Leveraged Financial Products

Leveraged products allow investors to amplify returns by gaining exposure beyond their initial capital. While the potential gains are attractive, the risks are equally significant. Leveraged exchange-traded funds, for example, move in magnified ways compared to their underlying indexes. Investors who consider these instruments must evaluate their tolerance for volatility. Knowledge of how these products are structured can help prevent costly mistakes and improve financial outcomes.

Risk Management Strategies in Volatile Markets

Volatility is a constant factor in modern financial markets. Risk management involves practices like diversification, stop-loss planning, and disciplined position sizing. Without a clear risk strategy, investors may face challenges that erode long-term returns. By consistently applying protective techniques, traders and investors can withstand sudden downturns. This stability makes it possible to pursue returns with greater confidence, even when unpredictable swings occur in global markets.

Investor Psychology and Market Sentiment

Market sentiment often drives trends more strongly than raw fundamentals. Fear and greed play central roles in how participants behave during shifts. Investor psychology explains why markets can overshoot valuations on both the upside and downside. Recognizing these emotional patterns helps investors maintain objectivity. Strategies that account for behavioral biases can improve decision-making. By staying aware of crowd-driven movements, investors create an advantage over those who simply follow short-term emotions.

The Role of Technology in Modern Investing

Technology has transformed the way individuals and institutions participate in markets. Trading platforms, analytical software, and automated systems have expanded access to tools once reserved for professionals. Retail investors now engage with financial products at unprecedented levels of efficiency. Technology also contributes to market transparency and liquidity. However, rapid access and automation can encourage overtrading. Balancing efficiency with discipline remains key to sustainable long-term results.

Case Studies from Historical Financial Cycles

Looking at past cycles gives valuable context for current market dynamics. Historical examples reveal how bubbles form, peak, and eventually correct. Each era provides lessons about investor behavior, regulatory responses, and macroeconomic influences. Learning from these patterns helps prevent repeating mistakes. By comparing current conditions with past cycles, investors identify similarities that may guide decision-making. These lessons are essential for creating resilient investment strategies across shifting conditions.

Sector Opportunities in Financial Services

The financial services sector often serves as a bellwether for economic strength. Banks, insurers, and asset managers reflect consumer confidence and business activity. As interest rates fluctuate, financial stocks can either benefit from stronger margins or face pressure from reduced lending. Monitoring sector-specific opportunities offers insights that extend beyond individual securities. Broader sector analysis also informs investors about where risks may cluster in the market.

Comparing Traditional Assets with Leveraged Instruments

Conservative assets such as bonds and blue-chip equities provide stability, but they typically yield modest growth. Leveraged instruments appeal to those aiming for amplified results within shorter periods. Choosing between these paths depends on individual goals, time horizons, and tolerance for volatility. A blended approach often works best, combining stability with selective growth opportunities. Careful consideration of each type of investment enables investors to construct balanced and effective portfolios.

Long term Perspective in Uncertain Times

While short-term trades capture attention, long-term planning drives consistent wealth building. Patience allows compounding to work in favor of disciplined investors. Uncertainty often creates noise, yet those who stick to structured plans tend to outperform impulsive traders. Evaluating goals and adjusting to new realities without abandoning strategy is essential. A long-term perspective brings clarity and resilience during inevitable economic shifts and unexpected global events.

Ethical Considerations in Investment Choices

Modern investors increasingly weigh ethical concerns when selecting investments. Environmental, social, and governance factors influence decision-making for both individuals and institutions. Ethical investing can align personal values with financial objectives, encouraging positive corporate behavior. While returns matter, investors also want their capital to drive change. As demand grows, companies with strong ethical records may attract more investment, shaping the direction of entire industries and sectors.

How DPST Stock Fits into the Broader Portfolio

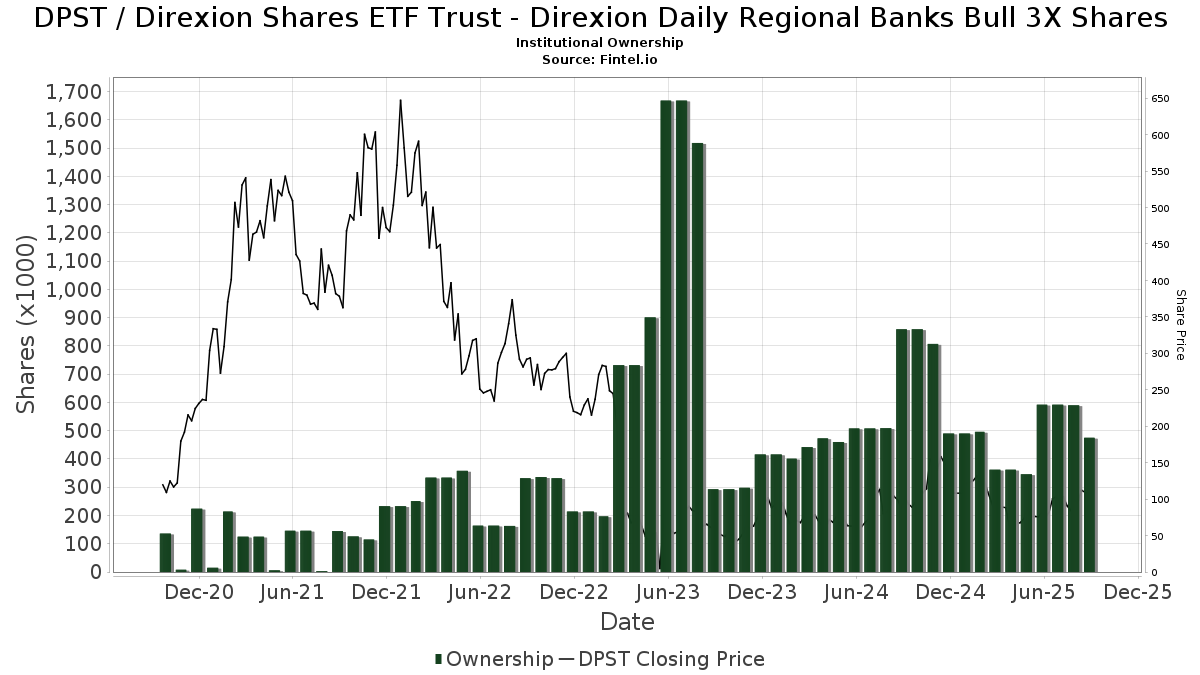

Among various leveraged products, DPST stock represents exposure to regional banking performance. Its leveraged design means results are intensified compared to traditional bank ETFs. Investors who include it in portfolios must remain mindful of volatility and timing. This security may complement aggressive strategies but requires strict discipline to manage potential losses. When used strategically, it can provide valuable diversification and tactical opportunities alongside more stable holdings.

Lessons from Current Market Dynamics

Today’s market environment highlights the importance of adaptability. Rapid changes in policy, technology, and global relations reshape investment landscapes at an accelerated pace. Investors who remain flexible, continuously learning, and willing to adjust strategies are better positioned for success. This adaptability extends to product selection, portfolio balance, and managing emotional responses. The ability to evolve with the market is a defining trait of consistently successful investors.

The Balance Between Growth and Security

Every portfolio requires a balance between growth opportunities and protective stability. Riskier assets may deliver higher returns, but they must be offset by dependable holdings. The exact balance varies depending on an investor’s stage of life and goals. Younger investors may accept more growth-oriented positions, while those nearing retirement prefer security. Achieving harmony between these two forces ensures financial resilience and long-term success in varying conditions.

Practical Tips for New Investors Entering Markets

Beginners often face overwhelming amounts of information. Starting with clear goals, gradual exposure, and continuous education helps new investors build confidence. Practicing with small positions or simulated accounts reduces the risk of costly mistakes. Newcomers should also develop habits of research, patience, and emotional control. By cultivating discipline from the start, investors create a strong foundation. Over time, these early practices become the backbone of sustainable success.

Conclusion

The world of investing continues to evolve with shifting trends, new technologies, and emerging risks. Assets like DPST stock highlight both opportunities and challenges in modern markets. While leveraged instruments require careful handling, they can provide valuable tactical options when managed correctly. A broad perspective that incorporates psychology, technology, ethics, and long-term planning ensures investors remain prepared. Success depends not only on product selection but also on discipline and adaptability.